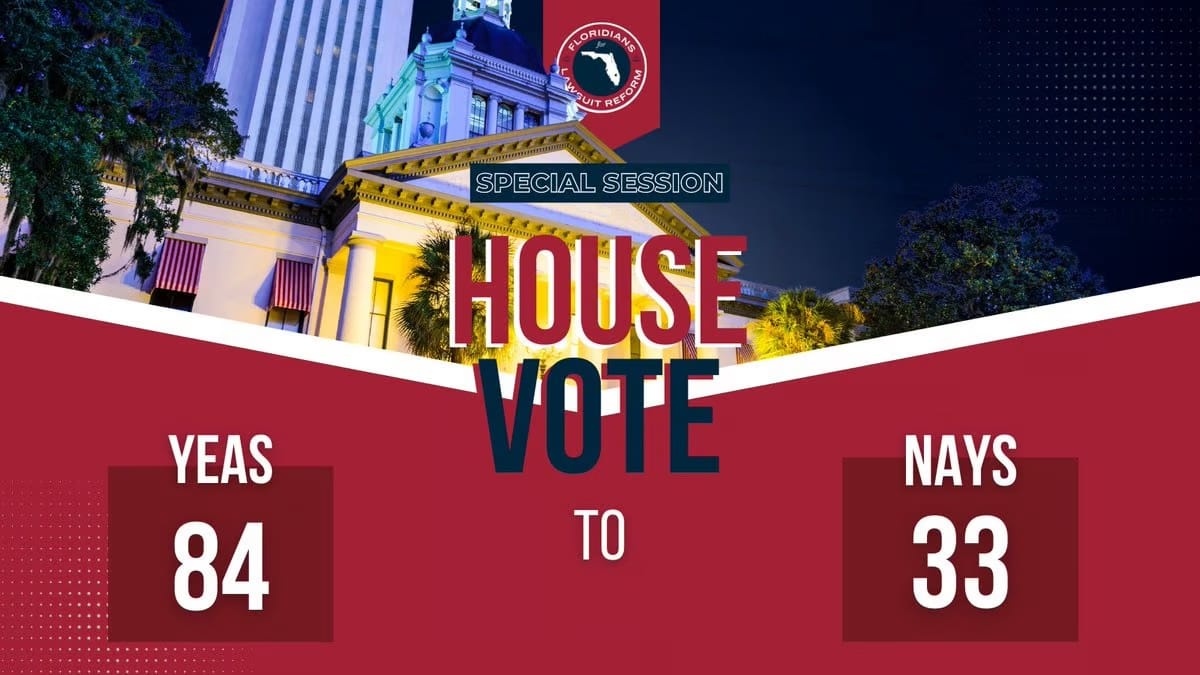

The House has passed SB 2A

The House has passed SB 2A and the bill is now on its way to Governor DeSantis’ desk for signature!

The House has passed SB 2A and the bill is now on its way to Governor DeSantis’ desk for signature!

Today, the Florida Legislature passed SB 2A, Property Insurance, which brings comprehensive reform intended to further stabilize Florida's property insurance market. Thank you to Senator @JimBoydFL & Representatives @leek_tj & @bob_rommel for your leadership on this legislation!

“These reforms will reduce litigation and stabilize the Florida property insurance market by encouraging new capital and giving reinsurers confidence to provide the coverage necessary for a healthy market,” Citizens’ President, CEO and Executive Director Barry Gilway said following the vote. “A stable market will benefit consumers by reducing the pressures that are driving up premiums."

The major provisions of the bill cover:

Attorney Fees: Ends one-way attorney fees in residential and commercial property insurance policy lawsuits;

Offers of Judgment: Reinstates the civil offer of judgment statute (also known as Proposals for Settlement) and makes attorney fees available for the prevailing party, while also allowing for joint offers of judgment;

AOBS: Prohibits Assignment of Benefits (AOB) contracts of residential and commercial property insurance policies issued on or after January 1, 2023;

Bad Faith: Prohibits the filing of a bad faith lawsuit until a final judgement is issued against the insurance company in the original claim dispute; Citizens Property Insurance Reforms: Makes many essential improvements to current laws governing the state-backed Citizens Property Insurance Corporation, including: Changing the eligibility to remain a Citizens policyholder, by requiring that private insurance company coverage has to be 20% more expensive (up from 15%, to match current rules on new policies) and likewise for commercial residential policies; Ending capped rates (the so-called “glide-path”) and requiring its rates be actuarially-sound and be “non-competitive” with admitted companies’ market rates; Defining and allowing higher rates for second (non-homesteaded) homes; and Requiring personal lines policyholders purchase flood insurance to become or remain a Citizens policyholder.

Reinsurance: Establishes a second optional hurricane reinsurance fund (The Florida Optional Reinsurance Assistance Program) for carriers, offering rates of 50% to 65% of the cost of on-line rates, while maintaining the Reinsurance to Assist Policyholders (RAP) program created in the May special session;

Arbitration: Allows carriers to include mandatory binding arbitration in their policies;

Claims Handling: Reduces from 90 days to 60 days the time insurance companies have to pay or deny a claim, unless extended by regulators; and reduce from 14 days to 7 days the time a carrier has to review and acknowledge a claim communication and begin an investigation, along with other time requirement changes;

Claim Filing: Further tightens deadlines for policyholders to report a claim from 2 years to 1 year for a new or reopened claim, and from 3 years to 18 months for a supplemental claim;

Greater OIR Regulation: Allows the Florida Office of Insurance Regulation (OIR) to withdraw approval of policies with an appraisal clause for companies that routinely invoke it; allows OIR to do market conduct exams after a hurricane on those companies in the top 20% of claims filed or DFS complaints and to include an examination of their MGAs; and requires companies begin monthly reporting of the numbers of claims opened, closed, pending, and those seeking alternative dispute resolution and of which type.